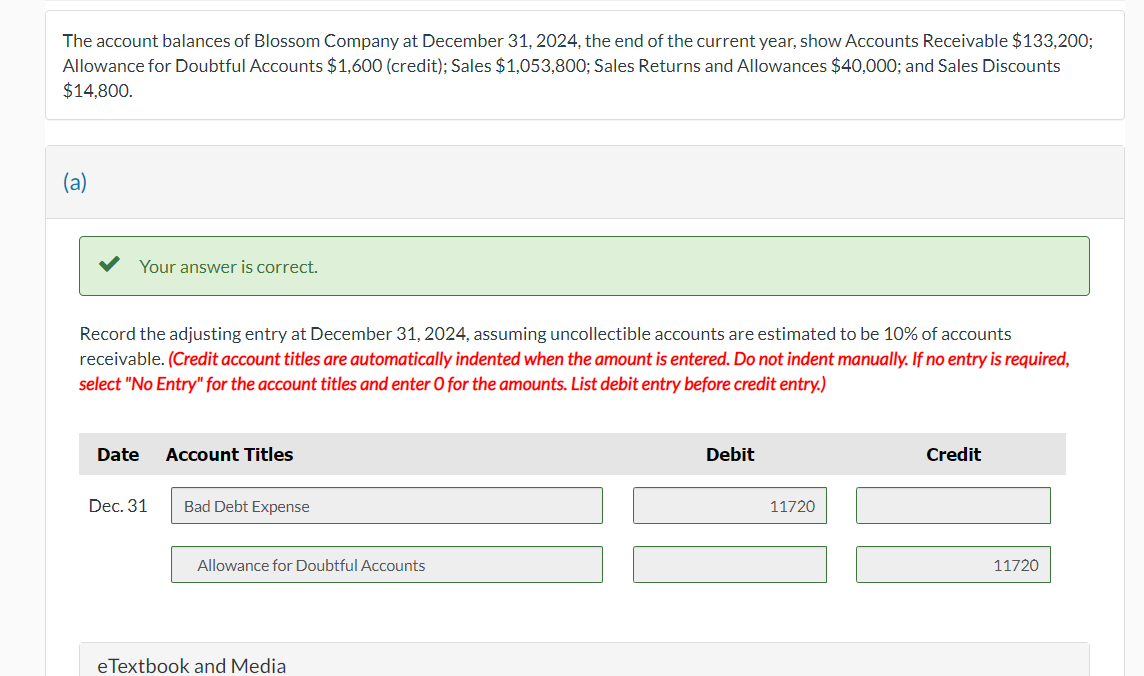

real account debit balance indicates Solved at december 31, 2022, the trial balance of blossom

If you are exploringiInvestigatingtTrying to find Solved Providing for Doubtful Accounts At the end of the | Chegg.com you've dropped by to the right page. We have 35 Sample Project about Solved Providing for Doubtful Accounts At the end of the | Chegg.com like Accounting Basics: Debits and Credits, Debit and Credit in Accounting | Double Entry Bookkeeping and also 3 Golden Rules of Accounting | Types, Benefits & Examples. Read more:

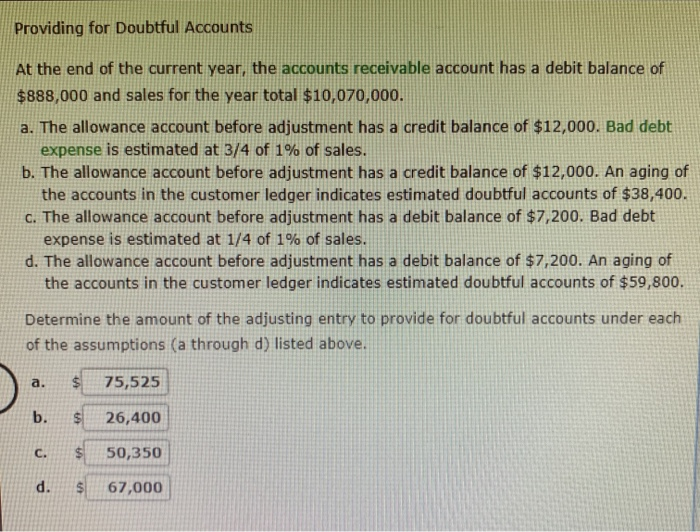

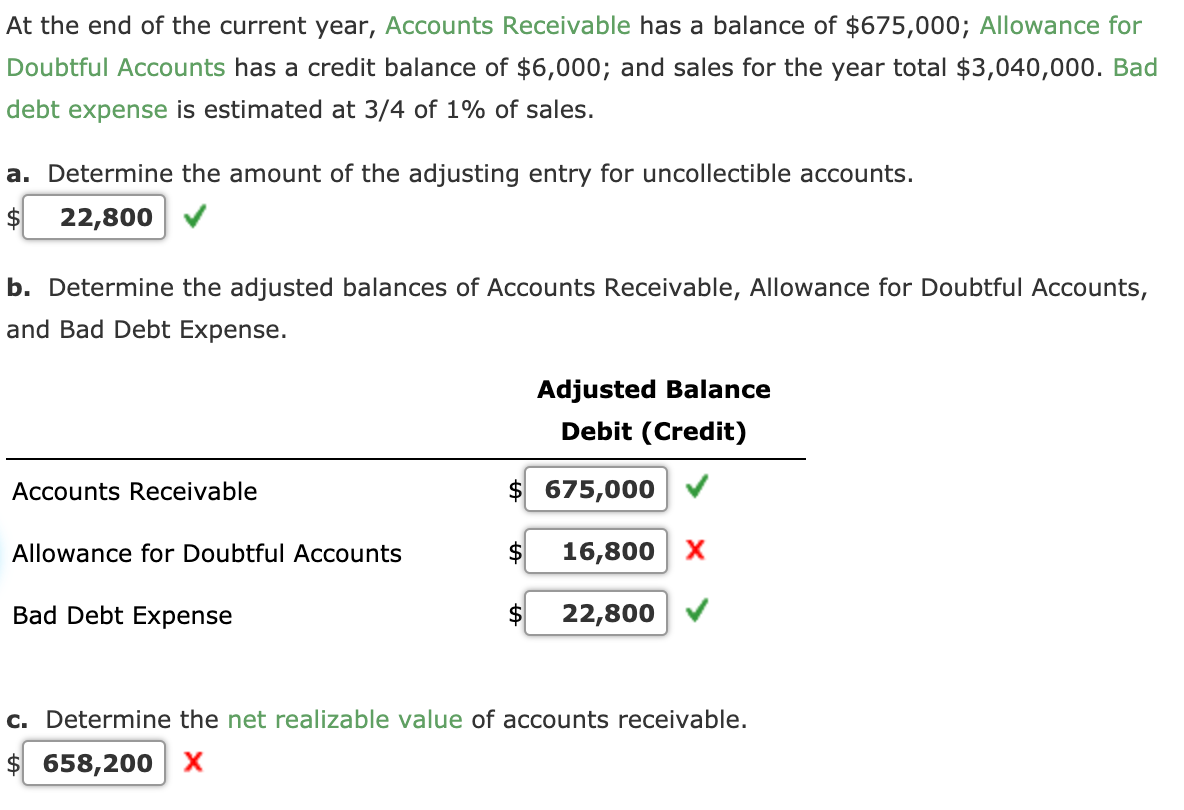

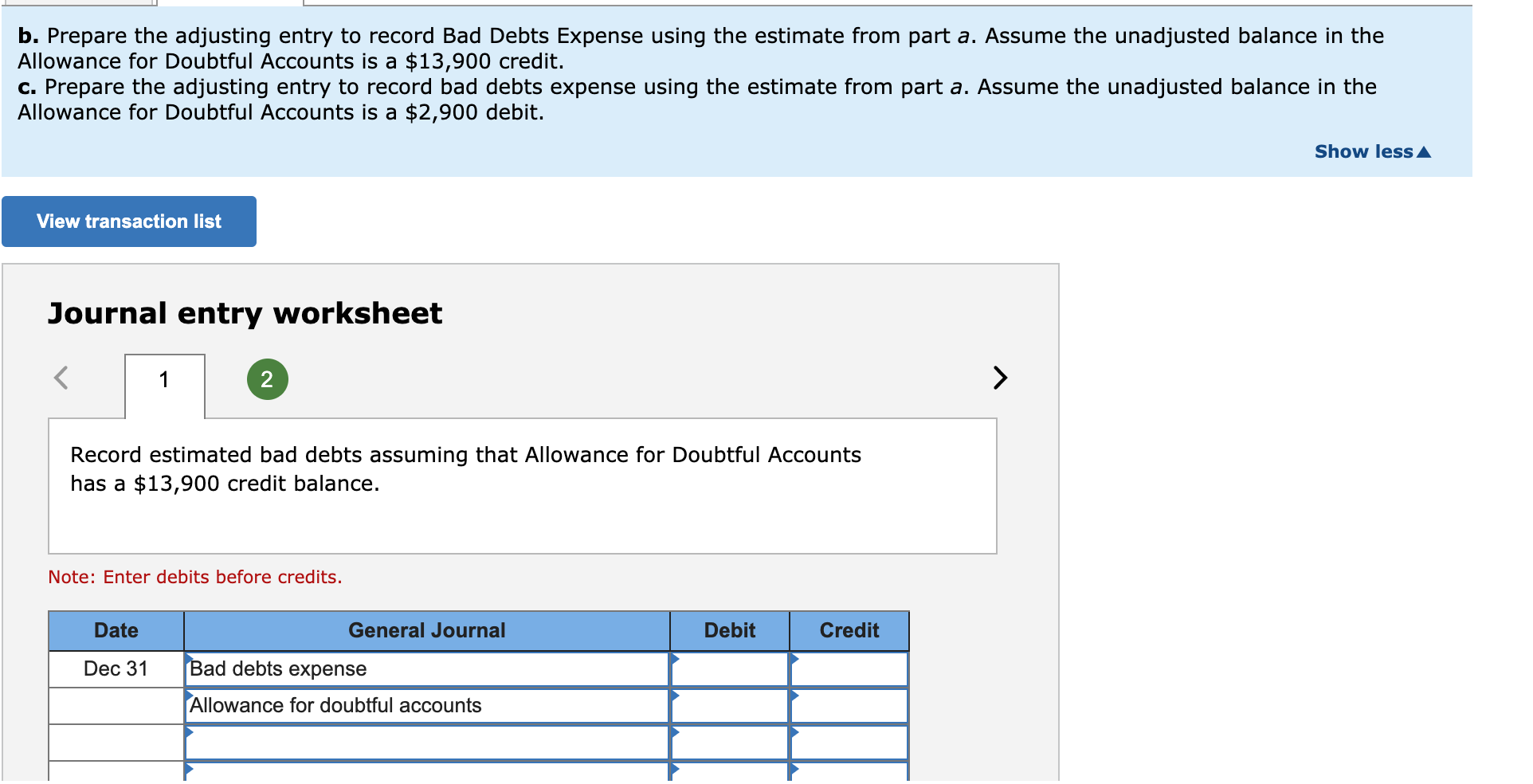

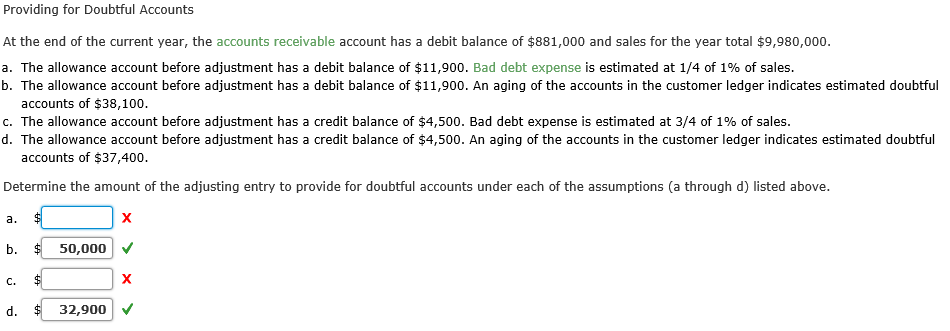

Solved Providing For Doubtful Accounts At The End Of The | Chegg.com

www.chegg.com

www.chegg.com

Accounting Basics: Debits And Credits

www.patriotsoftware.com

www.patriotsoftware.com

ledger credits debits general chart entries when accounting account accounts examples business small understanding affected each they keep

What Is Debit And Credit? | Explanation, Difference, And Use In Accounting

www.hashmicro.com

www.hashmicro.com

When Expenses Increase Debit Or Credit? Leia Aqui: Is Expenses

fabalabse.com

fabalabse.com

Which Of The Following Accounts Normally Has A Debit Balance

robertancelawson.blogspot.com

robertancelawson.blogspot.com

What Are Debits And Credits In Accounting

www.zarmoney.com

www.zarmoney.com

debits debit revenue statement decrease assets expenses liabilities transactions equity losses terminology record gains names

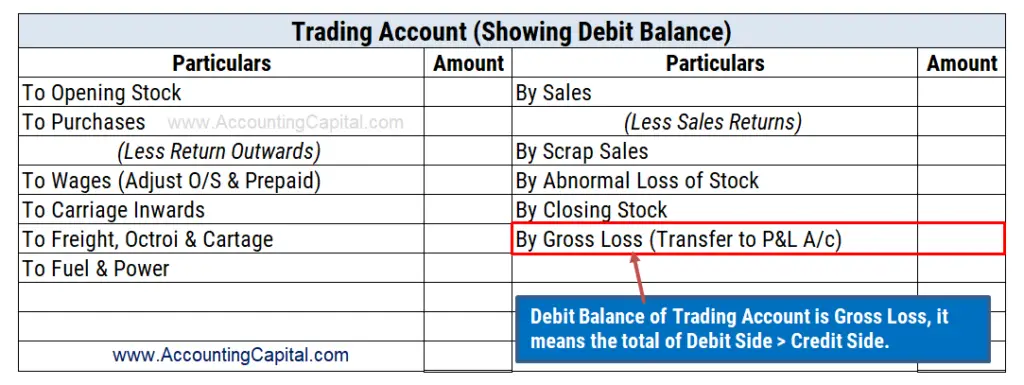

Meaning Of Debit Balance Of Trading Account | Example | Quiz

www.accountingcapital.com

www.accountingcapital.com

CHAPTER 2 Analyzing Transactions Into Debit And Credit

slidetodoc.com

slidetodoc.com

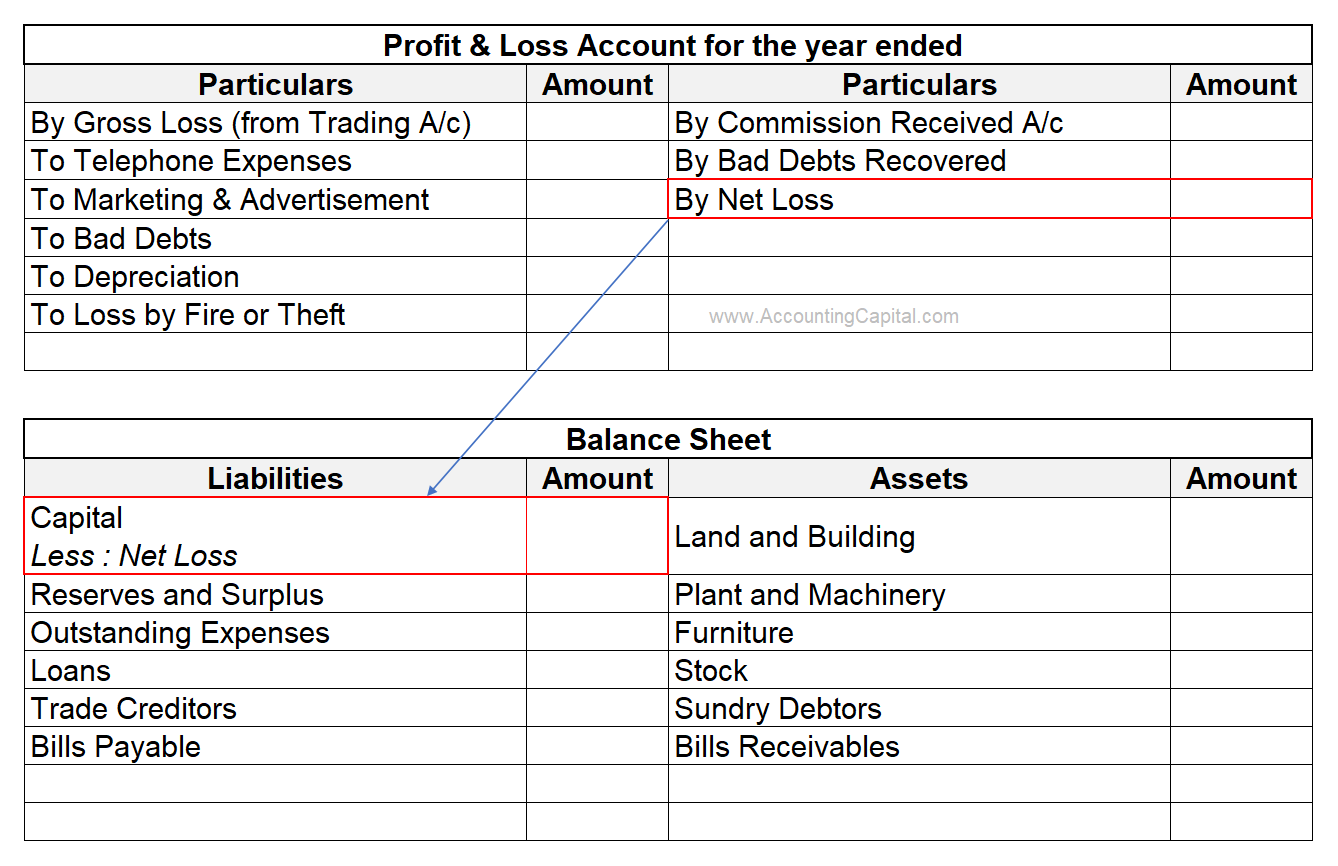

Debit Balance Of Profit And Loss Account (with Examples)

www.accountingcapital.com

www.accountingcapital.com

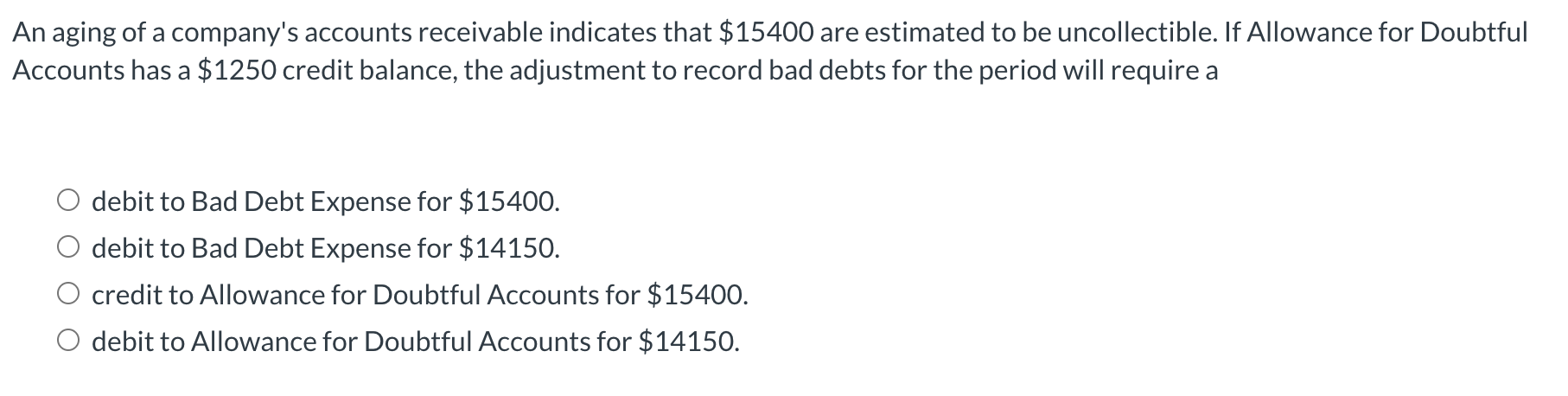

Solved An Aging Of A Company's Accounts Receivable Indicates | Chegg.com

www.chegg.com

www.chegg.com

3 Golden Rules Of Accounting | Types, Benefits & Examples

Debit And Credit In Accounting | Double Entry Bookkeeping

www.double-entry-bookkeeping.com

www.double-entry-bookkeeping.com

credit debit balance entry bookkeeping double accounting cr account dr example credits debits effect if then examples

What Is A Debit In Accounting? Leia Aqui: What Is Debit In Simple Terms

fabalabse.com

fabalabse.com

Debit Balance (Meaning, Example) | Difference Between Debit And Credit

www.wallstreetmojo.com

www.wallstreetmojo.com

Bookkeeping Cheat Sheet - Cheat Dumper

cheatdumper.blogspot.com

cheatdumper.blogspot.com

debits credits accounting cheat sheet balances permanent temporary bookkeeping debit accounts ledger entries accountingcoach dumper 07x

Solved Your Answer Is Partially Correct. Assume Instead That | Chegg.com

www.chegg.com

www.chegg.com

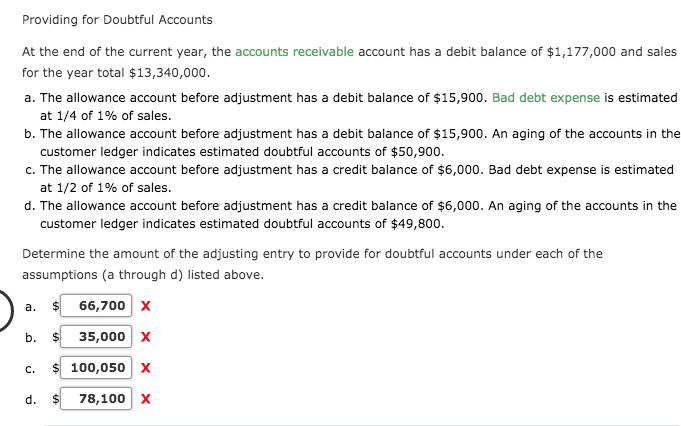

Solved Providing For Doubtful Accounts At The End Of The | Chegg.com

www.chegg.com

www.chegg.com

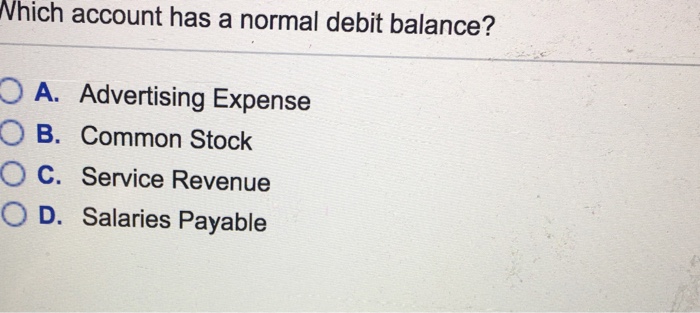

Solved Which Account Has A Normal Debit Balance? O A. | Chegg.com

www.chegg.com

www.chegg.com

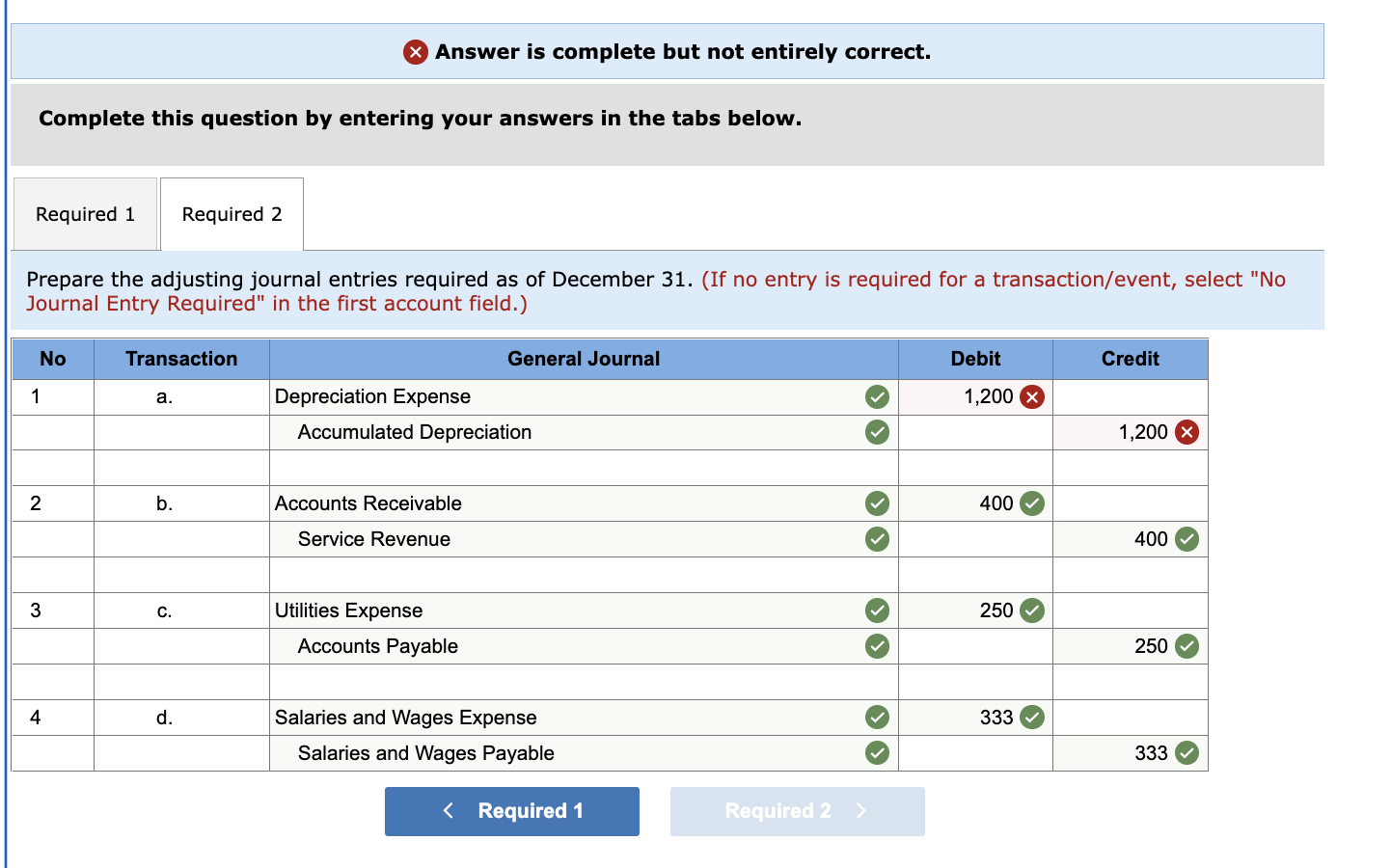

Solved E4-1 (Static) Explaining Why Adjustments Are Needed | Chegg.com

www.chegg.com

www.chegg.com

Debit Balance Of Profit And Loss Account (with Examples)

www.accountingcapital.com

www.accountingcapital.com

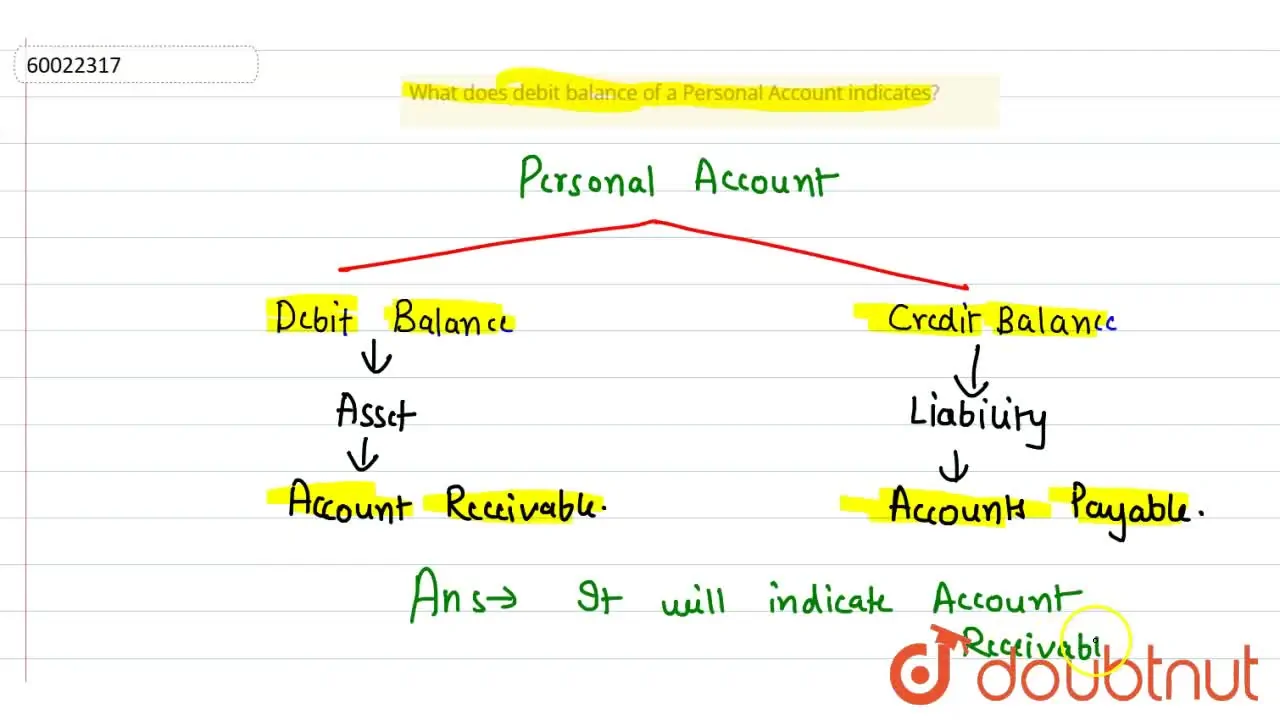

What Does Debit Balance Of A Personal Account Indicates?

www.doubtnut.com

www.doubtnut.com

Which Accounts Usually Have Debit Balances? - India Dictionary

1investing.in

1investing.in

Debit Balance Vs. Credit Balance: What’s The Difference?

www.difference.wiki

www.difference.wiki

Debit Credit Balance Sheet With Excel Formula (3 Suitable Examples)

www.exceldemy.com

www.exceldemy.com

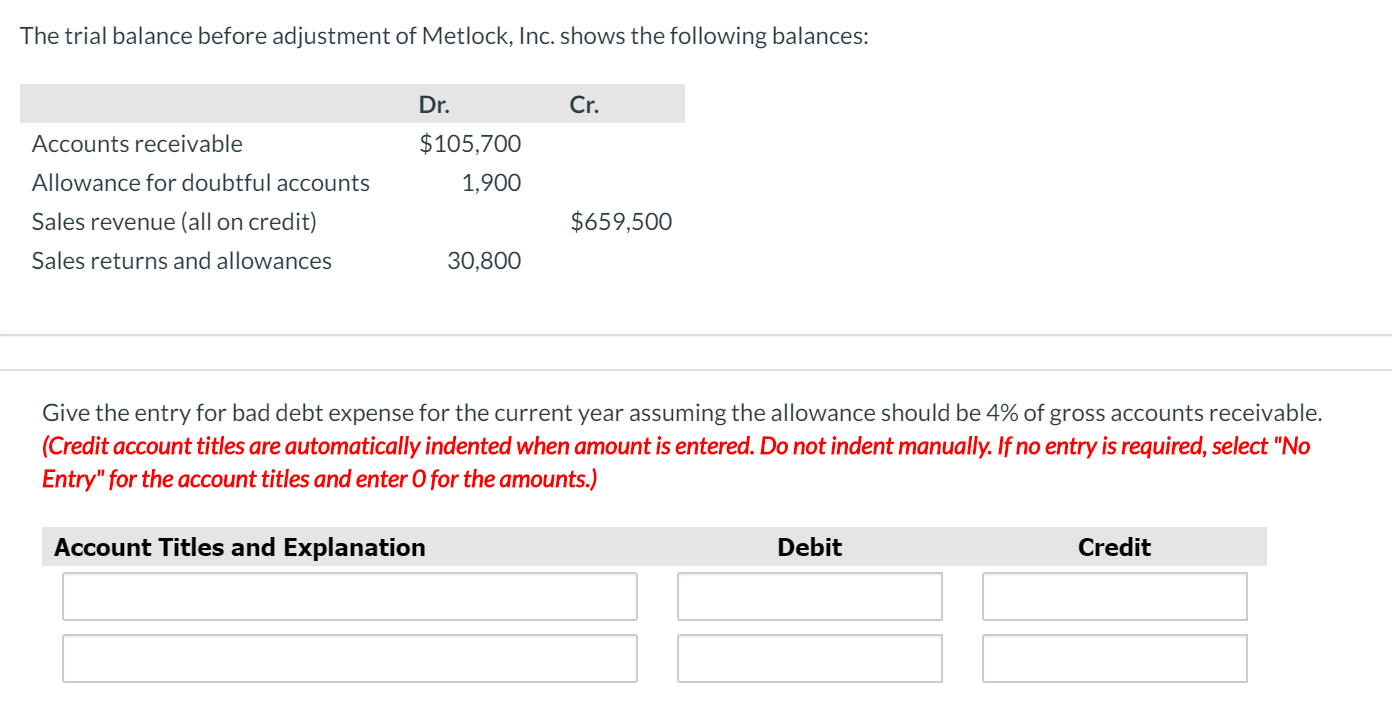

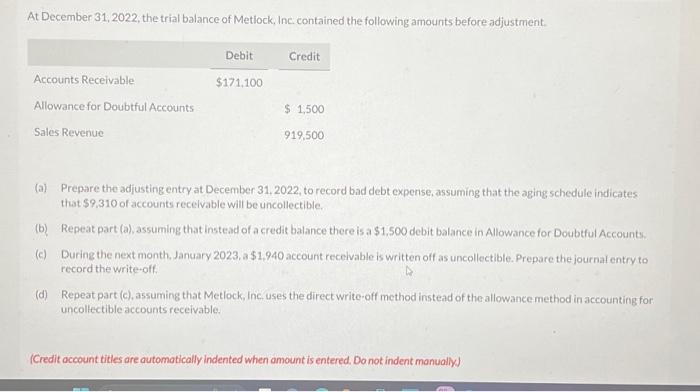

Solved The Trial Balance Before Adjustment Of Metlock, Inc. | Chegg.com

www.chegg.com

www.chegg.com

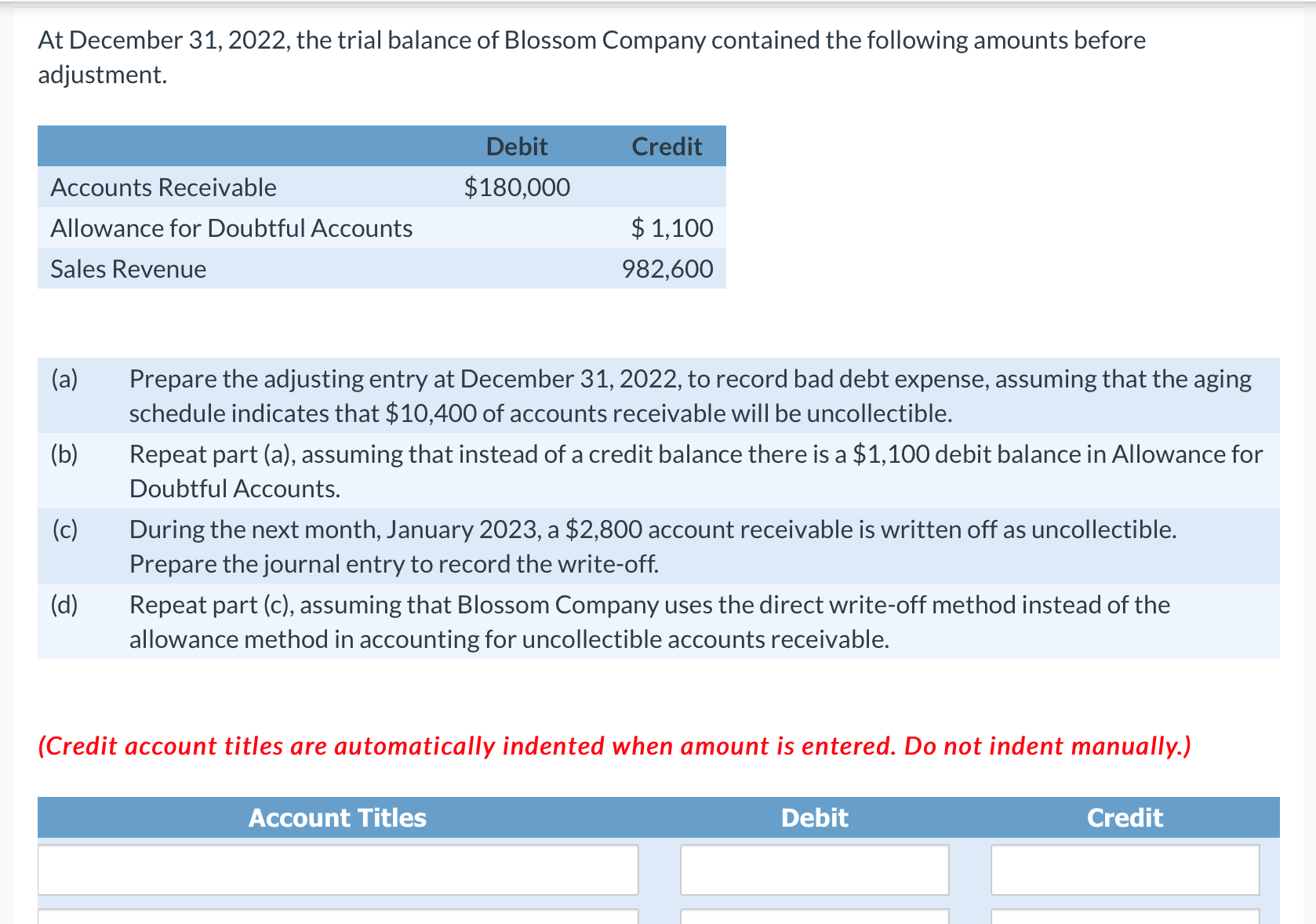

Solved At December 31, 2022, The Trial Balance Of Blossom | Chegg.com

www.chegg.com

www.chegg.com

Simple Debit And Credit Side Of Balance Sheet Classification Statement

associatenormal24.gitlab.io

associatenormal24.gitlab.io

Accounting T Accounts, Debit And Credit, Account Balances, Accounting

quizlet.com

quizlet.com

Solved At December 31, 2022, The Trial Balance Of Metlock, | Chegg.com

www.chegg.com

www.chegg.com

Accounting — The Accounting Cycle In A Merchandising Corporation

accessdl.state.al.us

accessdl.state.al.us

Which Account Has Debit Or Credit Balance? Leia Aqui: Which Accounts

fabalabse.com

fabalabse.com

Solved Use The Following Information For The Exercises 13-14 | Chegg.com

www.chegg.com

www.chegg.com

Debits And Credits Are At The Heart Of Bookkeeping. Read Our

www.pinterest.com

www.pinterest.com

debits credits cheat bookkeeping accounting debit entries basics

Solved Providing For Doubtful Accounts At The End Of The | Chegg.com

www.chegg.com

www.chegg.com

What Is The Beginning And Ending Balance Of An Account?

www.accountingcapital.com

www.accountingcapital.com

Chapter 2 analyzing transactions into debit and credit. Solved which account has a normal debit balance? o a.. Debits debit revenue statement decrease assets expenses liabilities transactions equity losses terminology record gains names